How to start your career without prior work experience?

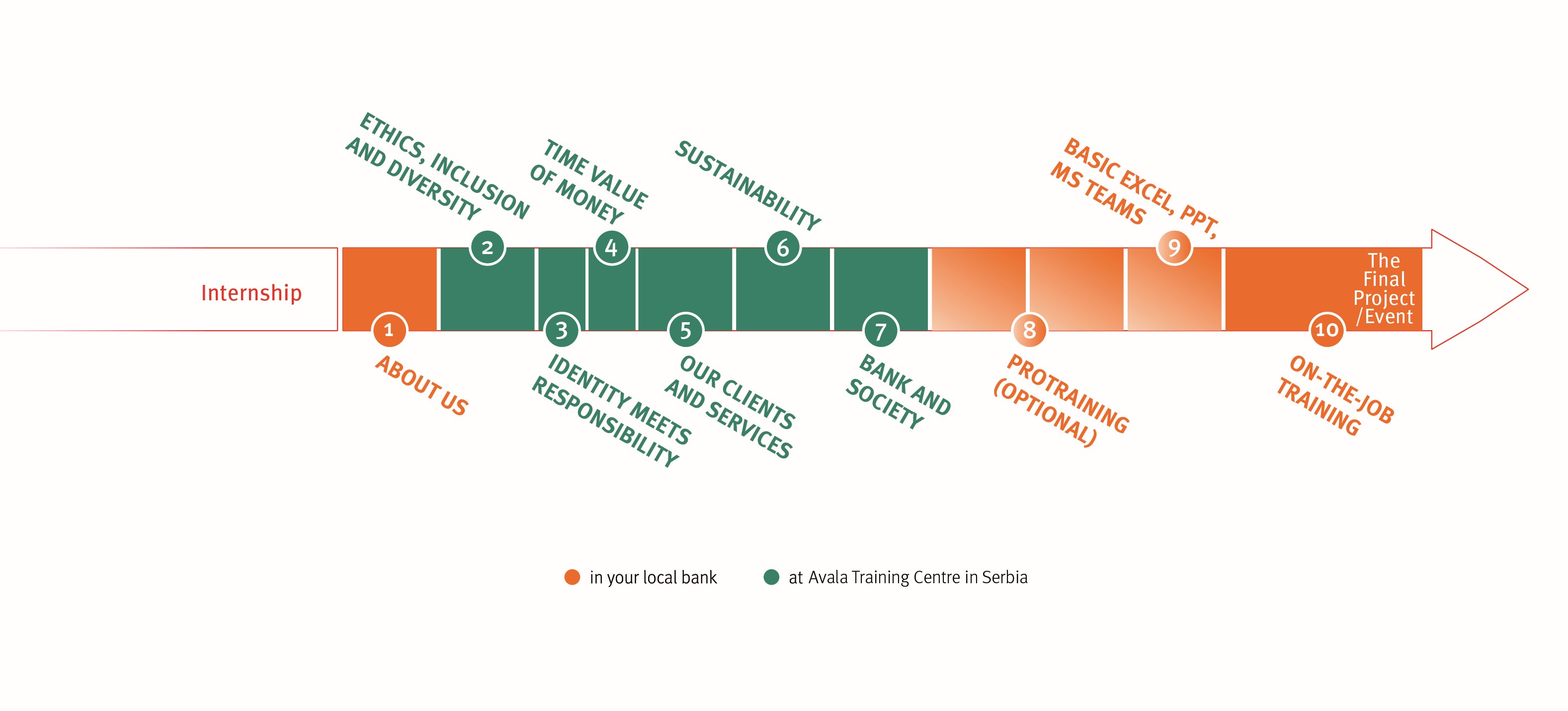

Training is an integral part of everything we do at ProCredit, and as a group, we invest heavily in the personal and professional growth of our staff members from day one. As our new colleague, you will be invited to participate in the ProCredit Onboarding Programme – an exciting introduction to life at ProCredit, which combines both theoretical and practical training modules divided into blocks. This is where you will have the opportunity to meet colleagues from other ProCredit countries, discover new cultures and enjoy a unique learning experience. To facilitate communication in this international environment, the programme is conducted in English, which is why English language skills are an important precondition for participation.

Step-by-step through the Onboarding Programme

Step-by-step through the Onboarding Programme

-

1. About us

-

Hello and welcome!

For those who have not completed an internship with us, this block will be your first point of contact with the ProCredit group. During the upcoming week, you will discover what ProCredit is all about. The sessions will take place at our head office in Belgrade and you can expect to receive answers to many of the questions you may have:

Who exactly is behind ProCredit? What drives the company? What is the ProCredit way of banking and what is the rationale behind it? Is ProCredit’s claim of being a “responsible bank” more than just hot air?

You will get to know our core values and principles, as described in our Code of Conduct, and most importantly, we will clearly explain to you who we are and who we are not.

-

2. Ethics, inclusion and diversity

-

Insight on our core values

This block goes beyond the surface of ProCredit’s financial operations and delves deeper into the philosophical landscape of the company. It explores the moral dimensions which define our business relationships and analyses the impact of morality and justice on decision-making within the group. Moreover, this block emphasises the significance of inclusion and diversity within the company, recognising the pivotal role these topics play in fostering innovation and creating an ethical and thriving work environment.

-

3. Identity meets responsibilty

-

What sets one company apart from the others?

“It is not only for what we do that we are held responsible, but also for what we do not do.” – Molière

This block challenges us to ask ourselves: Who am I? What makes me who I am? Who do I want to be? Do my actions reflect how I see myself?

Do these questions also apply to institutions such as ProCredit? Finding answers to these questions is not only vital for tapping into our own identity, but also for choosing an employer that is right for us.

-

4. Time value of money

-

This block focuses on gaining a better understanding of the key concepts of how time affects our money. You will learn valuable information about the compounding interest rate, the effective interest rate, loans and deposits.

-

5. Our clients and services

-

Do we choose our clients, or do they choose us?

In this block, we will discuss how long-term relationships are based on mutual understanding, trust and shared values. We will analyse how these ideas shaped our business model, which is based on the idea of providing efficient services to specific types of clients. ProCredit banks are specialised financial institutions for small and medium-sized enterprises, and we aim to be their “Hausbank” – the bank that handles most, or ideally all, of their banking business. We also actively acquire mid- and high-income private clients who are interested in modern banking services. This might make us seem exclusive, but for a long-term relationship it is very important that we share the same understanding of growth, development, transparency, and social and environmental awareness with our clients.

-

6. Sustainability

-

Why does sustainability matter to ProCredit?

In the wake of the catastrophic events that have taken place in recent years – drought, flooding, forest fires, to name a few – there is a growing realisation that exploitation of the Earth’s resources at present levels is not sustainable. These events have both direct and indirect consequences for the economies in which we operate.

In this block, we are challenged to ask ourselves what we, as individuals and as employees of a bank, can do to protect the planet we live on. At ProCredit, we are convinced that there is a lot we can do, which is why you will be introduced to our sustainable approach.

-

7. Banking and Society

-

The block enables you to take a closer look at the interplay between financial institutions and societal dynamics. You will be challenged to break free from banking stereotypes, understand the evolution of money, and navigate ProCredit’s role as a development bank. You will dive into the societal impact of banking and question individual and institutional roles in shaping and challenging norms within the rapidly changing financial landscape.

-

8. Protraining

-

During the ProTraining block of the Onboarding Programme, you are sent back to the bank, but will not yet begin with your daily tasks. A training session at the head office will:

- Further introduce you to our organisational structure

- Offer hands-on training on how to navigate and use ProCredit’s banking applications (including simulations)

- Include various mandatory trainings

- Give you the chance to interact with experienced team members and gain practical insight into various departments within the bank

-

9. Hard skills trainings

-

Before you assume your regular duties, we will help you to master the main tools required to work at ProCredit in this block. You will learn how to use Excel, Word, PowerPoint in your daily work. If you already have experience with these tools, you will be given useful tips on how to improve your skills even further. Both basic and advanced functions and techniques will be covered along with practical examples from daily work within the company. We will also address common issues or errors users might face and will provide resources for additional support using these applications.

-

10. On the job training

-

Back to the office!

You have been at ProCredit for some time now: you have successfully completed an internship as well as various training modules at the Avala Training Centre, in additional to other local workshops. Now the time has come for you to go back to the office and resume your practical training for the “real” work. Based on your contribution thus far as well as your potential and the current needs of the bank, we will assign to you a position that best suits your skills. This part of your trajectory is very much related to your specific position.

-

11. Final project

-

The final project marks the end of the ProCredit Onboarding Programme and serves as a milestone to show your determination, understanding and contribution. It is a chance for you to apply the knowledge and skills you have gained, reflect on your initial steps with the company, and be rightfully proud of your achievements and progress to date.