Energy efficiency loans

- receive a refund of up to 20% of your investment

- in collaboration with the GEFF and EBRD

A refund of up to 20% of your investment

Invest in making your home energy efficient and apply for a refund of up to 20% of your investment.

If you are using the loan to finance just one technology - you are entitled to a refund of up to 15%. If you are combining two or more technologies - you are entitled to a refund of up to 20%.

Purpose of the loan

Purpose of a loan eligible for a refund of up to 20%:

- Installing new windows, doors or glazing

- Insulating roofs, outdoor and partition walls, and the ground floor

- Installing biomass or gas boilers

- Installing solar water heaters or photovoltaic systems

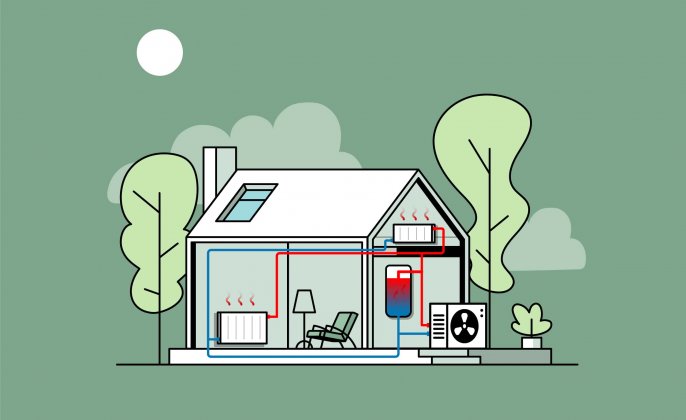

- Installing heat pumps

- Installing new lighting

- Installing balanced ventilation systems

- Installing hot water storage tanks

Items that can be financed through this loan, but are not eligible for a refund:

- Appliances (refrigerators, freezers, air conditioners, etc.)

Energy efficiency loan details

9%

Nominal fixed interest rate

9.53 %

Effective interest rate

71

months is the maximum repayment period

How do I apply for a loan and the refund?

The Tehnology Selector , developed by the GEFF, includes energy efficient technologies which are 20% more advanced than the average technologies available on our market which you can finance via this loan and become eligible for a refund.

Once you have chosen all of the technologies you wish to purchase in the Tehnology Selector, add these products to the List of certificates and then download a unique Certificate for all technologies combined.

If you are unsure of where to find a supplier that sells energy efficient products and technologies, the Technology Selector includes a map of suppliers that are closest to you.

View the loan conditions and submit a loan application online. You need to provide your last 6 account statements, an Eligibility Certificate for each technology you wish to purchase and a pro forma invoice issued by the supplier. If you do not have all of these documents at this time, you can apply now and submit the documentation at a later date.

Once your loan has been disbursed, you will receive confirmation that the funds have been deposited onto the supplier’s account. Once you complete your project and have installed the technologies, ask your supplier to provide you with an invoice.

Once you have completed your renovations, you need to register online by submitting an online Refund Application form through the Verification System. View our video instructions on how to fill in the Refund Application form. You will need to have an Eligibility Certificate, an invoice and proof of payment issued by the bank, the Loan Agreement and the number of your ProCredit Bank account into which your refund will be deposited. Your account number is located on your debit card.

The GEFF team is comprised of energy efficiency experts who will check and verify whether or not your investment is in compliance with the conditions of the loan. This may require fieldwork and on-site confirmation.

Once the GEFF expert has verified your investment, the bank will deposit up to 20% of the investment amount into your account. You are free to spend these funds as you see fit. You can use them to invest in further improvements or deposit them into your FlexSave account, for investment at a later date.

Choose the loan amount and submit your application online

Energy efficiency loan up to RSD 600,000

activate the account online, without having to visit the bank.

Energy efficiency loan over RSD 600,000

and the loan is disbursed during a bank visit.

Loan conditions

-

Conditions of an energy efficiency loan disbursed in collaboration with the GEFF - fixed interest rate

-

- Type of loan: Energy efficiency loan, with a refund of up to 20%

- Loan currency: RSD

- Indexing criteria: no criteria

- Loan amount: up to RSD 5.850.000

- Downpayment: none

- Repayment period: 12 - 60 months

- NIR (per annum, fixed): 9%

- EIR: from 10,87 %

- Loan application processing fee: 0,00%

- Additional expenses: 2 bills of exchange RSD 50/each, Credit Bureau Report - RSD 246, Total Account Package maintenance fee - RSD 595

- No maintenance fees on your loan account

- Payment per a pro forma invoice made to the seller

- Minimum earnings: RSD 36,000

Collateral:

-

for loan amounts up to RSD 600,000 no promissory notes and an administrative ban are required

-

for loans from RSD 600,000 to RSD 3.500.000 promissory notes and an administrative ban are required;

-

for loans from RSD 3.500.000 to RSD 5.850.000 promissory notes, an administrative prohibition and morgage are required

Payment in accordance with the loan agreement.

All examples are given with the transfer of earnings to an account maintained at ProCredit Bank and with the use of a Total package account.

The stated conditions are informative*The Bank reserves the discretion to request additional documentation from the client on the basis of credit risk assessment

-

Conditions of an energy efficiency loan disbursed in collaboration with the GEFF - variable interest rate

-

- Type of loan: Energy efficiency loan, with a refund of up to 20%

- Loan currency: RSD

- Indexing criteria: no criteria

- Loan amount: up to RSD 5.850.000

- Downpayment: none

- Repayment period: 12 - 180 months

- NIR (per annum, variable): 5.2% + 3m Belibor

- EIR: from 12.91%

- Loan application processing fee: 0,00%

- Additional expenses: 2 bills of exchange RSD 50/each, Credit Bureau Report - RSD 246, Total Account Package maintenance fee - RSD 595

- No maintenance fees on your loan account

- Payment per a pro forma invoice made to the seller

- Minimum earnings: RSD 36,000

Collateral:

- for loan amounts up to RSD 600,000 no promissory notes and an administrative ban are required

- for loans from RSD 600,000 to RSD 3.500.000 promissory notes and an administrative ban are required;

- for loans from RSD 3.500.000 to RSD 5.850.000 promissory notes, an administrative prohibition and morgage are required

Payment in accordance with the loan agreement.

All examples are given with the transfer of earnings to an account maintained at ProCredit Bank and with the use of a Total package account.

The stated conditions are informative

For a representative example, the value of 3M Belibor 5.71% was used (as of March 1, 2024).The Bank adjusts the nominal annual interest rate, which is contracted as variable, to the movement of the three-month BELIBOR, depending on the type of loan. Alignment with the three-month BELIBOR is done quarterly, on December 1, March 1, June 1. and 01.09. which precede the months in which the change takes effect, i.e. on the first following working day if it falls on a non-working day and are valid from the first day of the month of January, April, July, or October. 01.06. and 01.09. in the months in which the three-month BELIBOR is determined, in which the newly determined value of the three-month BELIBOR will be applied and will be valid until the next three-month determination in the manner described. On the day of concluding an individual contract with the client, the Bank will apply the value of the three-month BELIBOR - which are valid at the time of concluding the contract, and are determined in the manner described above.

*The Bank reserves the discretion to request additional documentation from the client on the basis of credit risk assessment

-

Loan examples

-

-

An example of an energy efficiency loan disbursed in collaboration with the EBRD and GEFF up to RSD 600,000 - variable interest rate

-

- Type of loan: special-purpose retail loan

- Loan currency: RSD

- Indexing criteria: no criteria

- Loan amount: RSD 600,000.00

- Downpayment: none

- Repayment period: 84 months

- NIR (per annum, variable): 5.2% + 3m Belibor

- EIR: from 13,74 %

- One-off loan processing fee: 0,00 %.

- Monthly instalment: 10.295 RSD

- Total loan amount the borrower returns after the repayment period of 84 months: 1.314,959,40 RSD

- Collateral:

- for loan amounts up to RSD 600,000 no promissory notes and an administrative ban are required

- for loans from RSD 600,000 to RSD 3.500.000 promissory notes and an administrative ban are required;

- for loans from RSD 3.500.000 to RSD 5.850.000 promissory notes, an administrative prohibition and morgage are required

- Additional expenses: 2 bills of exchange RSD 50/each, Credit Bureau Report - RSD 246, Total Account Package maintenance fee - RSD 595

- The example provided envisages the transfer of salary to an account held at ProCredit Bank and with the use of our Total Account Package.

- Disbursement in line with the Loan Agreement, to the dealer’s account.

- Minimum earnings: RSD 36,000

The stated conditions are informative

For a representative example, the value of 3M Belibor 5.71% was used (as of March 1, 2024).

The bank adjusts the nominal annual interest rate, which is contracted as variable, to the movement of the three-month BELIBOR, depending on the type of loan. Alignment with the three-month BELIBOR is done quarterly, on December 1, March 1, June 1. and 01.09. which precede the months in which the change takes effect, i.e. on the first following working day if it falls on a non-working day and are valid from the first day of the month of January, April, July, or October. 01.06. and 01.09. in the months in which the three-month BELIBOR is determined, in which the newly determined value of the three-month BELIBOR will be applied and will be valid until the next three-month determination in the manner described. On the day of concluding an individual contract with the client, the Bank will apply the value of the three-month BELIBOR - which are valid at the time of concluding the contract, and are determined in the manner described above.*The Bank reserves the discretion to request additional documentation from the client on the basis of credit risk assessment

-

An example of an energy efficiency loan disbursed in collaboration with the EBRD and GEFF in amounts exceeding RSD 600,000 - variable interest rate

-

- Type of loan: special-purpose retail loan

- Loan currency: RSD

- Indexing criteria: no criteria

- Loan amount: RSD 1,000,000

- Downpayment: none

- Repayment period: 84 months

- NIR (per annum, variable): 5.2% + 3m Belibor

- EIR: from 11.66 %

- One-off loan processing fee 0.00%.

- Monthly instalment: 17,154.48 RSD

- Total loan amount the borrower returns after the repayment period of 84 months: 1,440,976.91 RSD

- Collateral:

- for loan amounts up to RSD 600,000 no promissory notes and an administrative ban are required

- for loans from RSD 600,000 to RSD 3.500.000 promissory notes and an administrative ban are required;

- for loans from RSD 3.500.000 to RSD 5.850.000 promissory notes, an administrative prohibition and morgage are required

- Additional expenses: 2 bills of exchange RSD 50/each, Credit Bureau Report - RSD 246, Total Account Package maintenance fee - RSD 595

- The example provided envisages the earnings larger then 60.000 RSD and transfer of salary to an account held at ProCredit Bank and with the use of our Total Account Package.

- Disbursement in line with the Loan Agreement, to the dealer’s account.

The stated conditions are informative

For a representative example, the value of 3M Belibor 5.71% was used (as of March 1, 2024).

The bank adjusts the nominal annual interest rate, which is contracted as variable, to the movement of the three-month BELIBOR, depending on the type of loan. Alignment with the three-month BELIBOR is done quarterly, on December 1, March 1, June 1. and 01.09. which precede the months in which the change takes effect, i.e. on the first following working day if it falls on a non-working day and are valid from the first day of the month of January, April, July, or October. 01.06. and 01.09. in the months in which the three-month BELIBOR is determined, in which the newly determined value of the three-month BELIBOR will be applied and will be valid until the next three-month determination in the manner described. On the day of concluding an individual contract with the client, the Bank will apply the value of the three-month BELIBOR - and which are valid at the moment of concluding the contract, and are determined as described above.*The Bank reserves the discretion to request additional documentation from the client on the basis of credit risk assessment

-

An example of an energy efficiency loan disbursed in collaboration with the EBRD and GEFF up to RSD 600,000 - fixed interest rate

-

- Type of loan: special-purpose retail loan

- Loan currency: RSD

- Indexing criteria: no criteria

- Loan amount: RSD 600,000.00

- Downpayment: none

- Repayment period: 60 months

- NIR (per annum, fixed): 9,00%

- EIR: 11,76%

- One-off loan processing fee: 0,00 %.

- Monthly instalment: RSD 12,492

- Total loan amount the borrower returns after the repayment period of 60 months: RSD 785.494,07

- Collateral:

- for loan amounts up to RSD 600,000 no promissory notes and an administrative ban are required

- for loans from RSD 600,000 to RSD 3.500.000 promissory notes and an administrative ban are required;

- for loans from RSD 3.500.000 to RSD 5.850.000 promissory notes, an administrative prohibition and morgage are required

- Additional expenses: 2 bills of exchange RSD 50/each, Credit Bureau Report - RSD 246, Total Account Package maintenance fee - RSD 595

- Minimum earnings: RSD 36,000

The example provided envisages the transfer of salary to an account held at ProCredit Bank and with the use of our Total Account Package.

*The Bank reserves the discretion to request additional documentation from the client on the basis of credit risk assessment

Disbursement in line with the Loan Agreement, to the dealer’s account.

The stated conditions are informative

-

An example of an energy efficiency loan disbursed in collaboration with the EBRD and GEFF exceeding 600.000 RSD - fixed interest rate

-

- Type of loan: special-purpose retail loan

- Loan currency: RSD

- Indexing criteria: no criteria

- Loan amount: 1.000.000 RSD

- Downpayment: none

- Repayment period: 60 months

- NIR (per annum, fixed): 9,00%

- EIR: from 10,24%

- One-off loan processing fee: 0,00%

- Monthly instalment: 20. 824,71 RSD

- Total loan amount the borrower returns after the repayment period of 60 months: 1.264.582,93 RSD

- Collateral:

- for loan amounts up to RSD 600,000 no promissory notes and an administrative ban are required

- for loans from RSD 600,000 to RSD 3.500.000 promissory notes and an administrative ban are required;

- for loans from RSD 3.500.000 to RSD 5.850.000 promissory notes, an administrative prohibition and morgage are required

- Additional expenses: 2 bills of exchange RSD 50/each, Credit Bureau Report - RSD 246, Total Account Package maintenance fee - RSD 595

- Minimum earnings: RSD 36,000

The example provided envisages the transfer of salary to an account held at ProCredit Bank and with the use of our Total Account Package.

*The Bank reserves the discretion to request additional documentation from the client on the basis of credit risk assessment

Disbursement in line with the Loan Agreement, to the dealer’s account.

The stated conditions are informative.

-

FAQs

-

What is the GEFF?

-

The GEFF is a green economy financing facility developed by the European Bank for Reconstruction and Development to support the financing of efficient technologies in households.

The total amount of the facility is €85 million.

The programme is supported by European Union funds, as well as other donators: Federal Ministry of Finance of the Republic of Austria and the Western Balkan Investment Framework, financing technical collaboration programmes through this facility, implemented in cooperation with the Energy Community Secretariat.

-

How do I apply for a refund?

-

To receive a refund, all you need to do is to register on the GEFF website, by submitting the online application form through the Verification System. You need to submit the following documentation: Eligibility Certificate, invoice, bank-issued proof of payment, Loan Agreement, and information concerning the bank account to which the funds are to be transferred.

-

How do I calculate the potential savings of my investment in energy efficient technology?

-

There is a calculator located on the GEFF website that you can use to calculate any potential energy efficiency savings on your investment.

Enter the characteristics of your home and check mark the technologies you intend to install. You will then receive an approximation of the amount of energy efficiency savings you can expect to receive as well as annual expenditures.

-

Are additional expenditures and installation included in the grant?

-

Additional installation costs and ancillary activities, such as the purchase of supporting materials, that do not fall under the category of energy efficient materials, delivery and installation, are all included in the grant, up to a certain amount and according to the following table.

Eligible technologies Auxiliary costs (percentage of the technology cost)

- Thermal insulation of outdoor walls 600%

- Partial thermal insulation of partition walls 200%

- Thermal insulation of roofs and top floors/attics 100%

- Thermal insulation of floors 100%

- Biomass boilers 100%

- Gas pumps 100%

- Heat pumps 70%

- High efficiency lighting systems 50%

- Solar water heaters 50%

- Doors, windows 25%

- Ventilation systems (mechanical ventilation with heat recovery) 25%

- Hot water storage tanks 25%

- Built-in, integrated photovoltaic systems 10%

- Air conditioning systems, refrigerators, freezers and combination refrigerators/freezers – not eligible for a refund 10%

-

Can the pro forma invoice also list products that are not eligible for the financial grant, air conditioners, for example?

-

Yes, it can. You are eligible for a loan to purchase air conditioners and other products (refrigerators, freezers or combination appliances) not listed in the Technology Selector; however, you will not receive a financial grant, that is, a refund.

-

Can I finance works/renovation performed on more than one location (more than one flat) through a single loan?

-

Yes. You can finance the installation of technologies on more than one project i.e., on multiple locations, all through a single loan.

-

Can I use the loan to purchase multiple products from different categories?

-

Yes. You can use the loan to purchase multiple products from different categories (e.g., installing new windows or biomass boilers). This, in fact, is recommended. In this way, you are entitled to a larger refund i.e., up to 20% when you invest in a minimum of 2 technologies.

While investing in a single technology includes a 15% grant.

-

Can I apply for more than one loan for the same purpose in the same building or flat?

-

No. For example, if a loan was already approved for the purpose of installing windows, the same windows cannot be replaced through another loan for the same purpose.

-

Can I apply for more than one loan for a single-location project?

-

Yes. You can apply for more than one loan on a single-location project (e.g., you can finance insulation through one loan, and install new windows through another).

-

Do I have to be the owner of the building/facility under renovation?

-

No. You do not need to own or co-own the building/facility, nor do you need to be registered at its address. You can take out a loan for family members. The only limitation is that you cannot finance the installation/ purchase of the same type of product twice, at the same address.

-

Can I finance the thermal insulation of just one flat of a residential building?

-

No. This loan cannot be used to finance the thermal insulation of just one flat of a residential building. You can finance the thermal insulation of just one flat if the entire façade of the building is being renovated.

-

Can two members of the same household apply for the financing of a single project i.e., receive two loans?

-

Yes, they can. In this case, project financing is secured as one loan and if more than one technology is included, a higher grant is given (20% instead of 15% for just one technology).

For example, if one spouse takes out a loan for insulation, and the other a loan to purchase a heat pump, this is treated as an investment in two types of technologies and entitles you to a higher refund of 20%, despite the fact that each of these individual loans is connected to just one technology.

-

Can I apply this grant or another grant to the same project?

-

No. You are eligible for a financial grant issued by EBRD i.e., refund, only if you have not/plan not to apply for a grant from another institution or government subsidy. You are prohibited from applying for more than one grant for the same project.

Energy efficiency household loans where private borrowers are eligible for a refund are provided in collaboration with the European Bank for Reconstruction and Development (EBRD) through the Green Economy Financing Facility (GEFF).